The seemingly straightforward nature of trading in financial markets can be deceiving. Merely possessing a computer and an internet connection, and executing trades with a simple click of a button, does not encompass the entirety of the process. As a well-known statistic indicates, over 95 percent of day traders in the stock market and foreign exchange market experience financial losses along their trading journey. This stark reality highlights the formidable challenges associated with investing in financial markets, particularly in the short term. It is widely regarded as one of the most arduous professions globally, primarily due to the inherent risk of using personal funds and the potential for complete loss. Nonetheless, the allure of substantial financial gains, including the possibility of multiplying one’s capital, remains an irresistible temptation.

Consistently generating profits in the foreign exchange market and global markets is a coveted aspiration for many professionals in the financial industry. Various theories and strategies, such as technical analysis, fundamental analysis, and sentiment analysis, aim to forecast price movements. However, achieving consistent success in these markets necessitates years of experience and a deep understanding of their intricacies.

The prevailing notion that most traders lose their entire capital has led some market participants to perceive price movements as random and unpredictable. They doubt the possibility of discerning patterns from such movements and regard trading as a form of gambling, where there is an equal 50% chance of making or losing money. However, it is crucial to acknowledge that trading in financial markets is fundamentally distinct from gambling. Price movements are not haphazard, but rather driven by underlying reasons and factors. Financial markets adhere to a scientific framework that sets them apart from games of chance, such as roulette in a casino. The primary reason for most traders’ losses lies in underestimating the inherent risks involved, rather than attributing trading outcomes solely to chance.

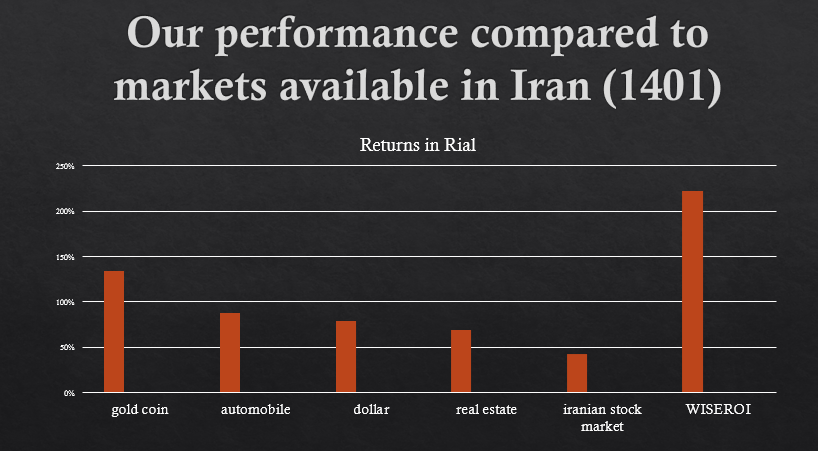

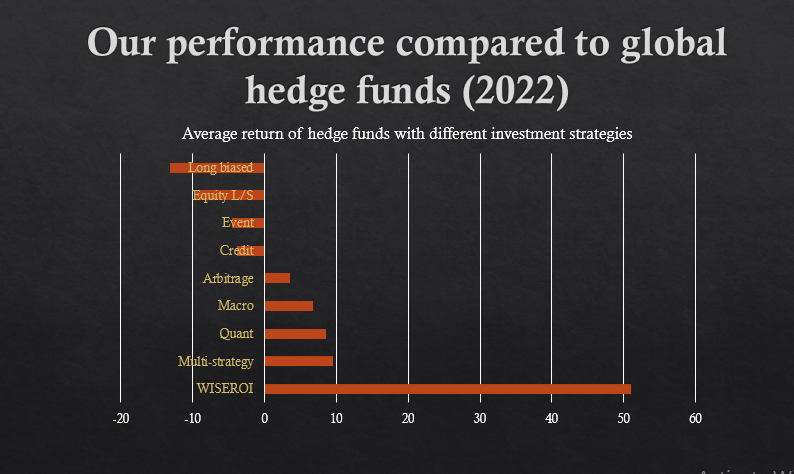

At WISEROI, we offer a comprehensive solution that addresses these concerns. Our meticulously designed trading strategy has consistently yielded profitable results over the years while prioritizing the preservation of initial capital and limiting maximum drawdown. By mitigating risks and implementing strategic measures, we navigate the challenges of financial markets to achieve sustainable returns for our valued clients.